Educational

Delve into the ‘Educational’ category on AltcoinCult to access a wealth of knowledge designed to enhance your understanding of cryptocurrency and blockchain technology. This section features articles that cover fundamental concepts, trading strategies, market analysis, and best practices for investing in altcoins. Whether you’re a beginner or looking to deepen your expertise, our educational content will equip you with the tools you need to navigate the crypto landscape confidently.

-

Getting started with cryptocurrency and its associated concepts can be…

-

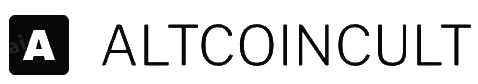

A typical question that especially newbies who are just starting…

-

What is Shibaswap? Shibaswap is a new way to swap…

-

Cryptocurrencies have become increasingly popular in recent years, with more…

-

Crypto is a volatile market. Enter at your own risk. This…

-

Non-Fungible Tokens are a new and exciting form of digital…

-

Most of us are aware of traditional stocks, but how…

-

Crypto mining is the process of acquiring cryptocurrency by solving…

-

Decentralized finance is a new and emerging industry that is…