Mack Lahren

-

Getting started with cryptocurrency and its associated concepts can be…

-

With specialized marketplaces such as Kraken, you can now purchase…

-

What are NFTs and What Is Their Potential? NFTs emerged…

-

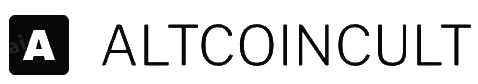

A typical question that especially newbies who are just starting…

-

What is Shibaswap? Shibaswap is a new way to swap…

-

Cryptocurrencies have become increasingly popular in recent years, with more…

-

Crypto is a volatile market. Enter at your own risk. This…

-

Non-Fungible Tokens are a new and exciting form of digital…

-

Most of us are aware of traditional stocks, but how…

-

Crypto mining is the process of acquiring cryptocurrency by solving…